Why NeoTrader Is the Best App for Swing Trading in 2025

Explore why NeoTrader is the best app for swing trading in 2025. Uncover its powerful features, real-time insights, and user-friendly interface

Hello Traders,

If you’ve been following the market lately, you already know — it’s a bit of a jungle out there. Volatility, sideways moves, fake breakouts. And if you're not equipped with the right strategy, it’s very easy to get stuck.

That’s exactly why, in our latest workshop, I focused on how you can master Swing Trading using NeoTrader — and more importantly, how to do it without spending your entire day glued to the screen.

Let me walk you through it the same way I did in the webinar.

🎯 What is Swing Trading with NeoTrader?

Swing Trading here is not about intraday.

It’s about carry-forward trades where you hold positions for 2–5 trading days — not calendar days, trading days.

Simple logic:

-

•Identify high-probability setups•Take the trade•Set entry, target, and stop-loss•Let the trade work over a few days•Peace of mind — very little monitoring needed.

This is a passive income style strategy. Ideal for traders who:

-

•Can’t watch the screen all day•Want to trade part-time•Prefer smart, low-effort execution

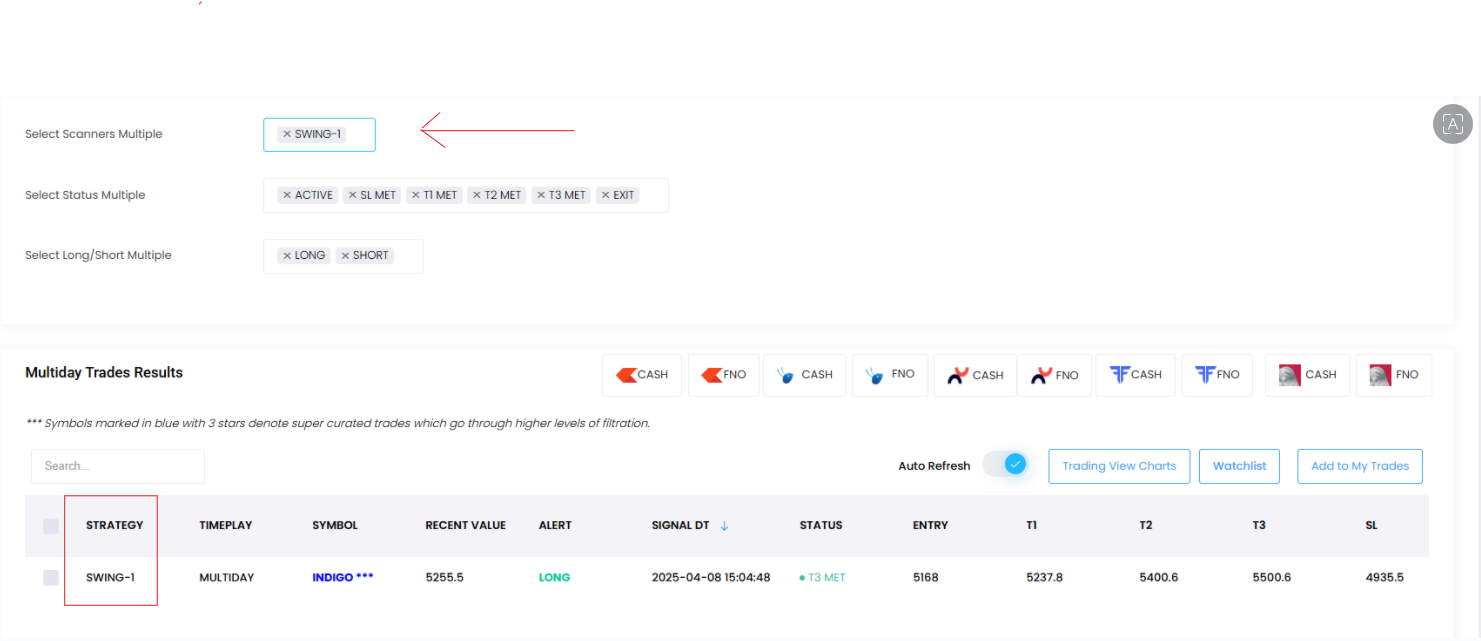

📈 How to Access These Swing Trades?

All the swing trades are ready-made inside NeoTrader under the Multiday Trades Page.

👉 You simply need to filter and select the "Swing Strategy" from the strategy dropdown.

👉 You'll get a shortlist of 1–2 trades per week, highly curated and ready to act upon.

You don't have to scan hundreds of stocks anymore.

NeoTrader does the hard work — picking stocks that are showing pullback opportunities within ongoing trends.

💥 Why Swing Strategy Works?

In today’s choppy, pullback-prone markets, buying after a pullback (instead of chasing a breakout) gives you much better odds.

This Swing Strategy is designed exactly for that:

-

•Buy stocks after they stabilize from a pullback•Sell short after a failed rally•Trade with the flow, not against it

And guess what?

📊 Past 14 months data (Jan 2024–April 2025) shows:

-

•78% Success Rate ✅•226 trades in total (manageable frequency)•1:1 to 1:2 Risk-Reward ratio at T2 and T3 targets•Works even during volatile, sideways markets!

| Metric | Result |

|---|---|

| Timeframe | Jan 2024 – April 2025 (14 months) |

| Total Trades Executed | 226 trades |

| Winning Trades | 177 trades |

| Losing Trades | 49 trades |

| Overall Success Rate | 78% |

| Style of Trading | Carry Forward (2–5 Trading Days) |

| Frequency | 1–2 trades per week |

| Trading Type | Stocks (Equity & Futures) |

| Ideal Market Condition | Pullback/Choppy Trends |

| Monitoring Required | Minimal (5 minutes/day) |

🛡 How to Execute These Trades Smartly?

👉 Trades come by 3 PM every day inside NeoTrader

👉 Set your Entry, Target, and Stop-loss (already given)

👉 Prefer using GTT orders or Smart Orders (like in Zerodha, Dhan, etc.)

👉 Minimum monitoring.

👉 You can do it with equity or futures, depending on your preference.

And remember:

-

•Long trades → Equity or Futures•Short trades → Only Futures

📌 What Target Should You Aim For?

If you’re wondering whether to exit at T1, T2, or T3 — here’s the quick takeaway:

-

•T2 is the sweet spot → Around 4.5% move, 1:1 Risk-Reward.•T3 is even bigger → 9% move, 1:2 Risk-Reward — if you can hold patiently.•T1 is quicker, but Risk-Reward is tighter.

My advice:

If you want steady success, aim for T2.

If you can wait, T3 is the jackpot.

| Target Level | Approx Return | Risk-Reward Ratio | Win % (Approx.) | Notes |

|---|---|---|---|---|

| T1 (Target 1) | ~1.4% per trade | Less than 1:1 | Highest (Max wins) | Good for faster exits, but not ideal for full potential |

| T2 (Target 2) | ~4.5% per trade | 1:1 Risk-Reward | High | Recommended for steady consistent profits |

| T3 (Target 3) | ~9.0% per trade | 2:1 Risk-Reward | Moderate (fewer trades hit T3 but profitpotential is much higher) | Jackpot trades for patient traders |

| Stop Loss | ~4.5% per trade | - | - | Risk defined upfront |

🚀 Final Thoughts: Swing Your Way to Success

This strategy is perfect for traders who want:

-

•Fewer trades•Higher quality setups•Consistent profits over the month•Zero stress of daily screen watching

It's ready. It's tested. It's already working for hundreds of NeoTrader users.

All you need to do?

👉 Log into NeoTrader

👉 Go to Multiday Trades → Select Swing Strategy

👉 Follow the plan.

Simple. Effective. Repeatable.